Supervised by: Jonathan Bert McLelland Jr. BA, MA. Bert completed an interdisciplinary Bachelor of Arts in Political Theatre at the University of Alabama (UA). Bert then completed a Master of Arts at UA in Communication Studies, focusing on rhetoric and political discourse. In 2020 (in the course of this degree) he co-authored two academic papers which have since been published. Bert has recently completed a second MA in Public Policy at King’s College London.

As a professional Bert has worked on multiple political campaigns in Britain and America. He was an intern on the 2018 Alabama gubernatorial campaign of Democratic nominee Walt Maddox, and in 2019 he worked in Cardiff as a communications officer with the People’s Vote Campaign. During the 2020 election, Bert worked as a digital organizer and debate strategist for a congressional campaign and then ran social media for the first Democratic state senate campaign to unseat a Republican in 35 years.

Abstract

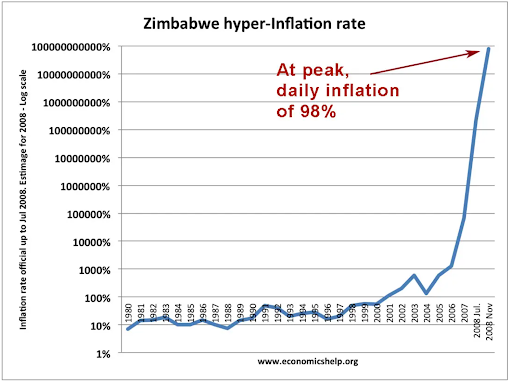

Inflation is more relevant now than ever. Recent world events that have contributed to the surge in inflation in Europe and North America have left many baffled, asking questions like: What is inflation? Where did it come from, and how do we stop it? Therefore, the importance of cogent information on the past, present and future consequences of inflation is paramount if economies are to come out the other side of this crisis dynamic and with expanded capacities – rather than deflated. We use data from the International Monetary Fund (IMF) to help explain inflation targeting and when different countries adopted the technique. We also use a graph (Tejvan Pettinger) to bring attention to a possible outcome of hyperinflation, as demonstrated by Zimbabwe. We researched problems involving inflation and found different examples of how inflation has been on the rise recently. We collected data from a wide array of journalistic and scholarly sources to help us explain recent problems with inflation. Throughout this study we have managed to look at inflation and its history as well as its main causes and how it affects different economies and people from all over the world. Our research has looked at and proposed multiple solutions to be taken into consideration in order to navigate this world of high inflation.

Introduction

An increase in the general level of prices in an economy is known as ‘inflation’. Inflation is not merely the increase in price of a bag of potato chips at a local gas station, but instead is the overall increase in price level of goods and services in an economy. Inflation leads to a decrease in the purchasing power of the currency, which means that the same amount of money will buy fewer goods. To consider the history of inflation, one early example of mass inflation was during the Mongol Yuan Dynasty; the government spent massive amounts of money fighting costly wars and wanted to raise more money to pay off debt, leading to the printing of even more money (Johnson, 2000). This increase in money supply caused a rise in prices that is referred to as inflation. Historically, large infusions of gold and silver also lead to inflation. From the second half of the 15th century to the first half of the 17th, Western Europe experienced a major inflationary cycle referred to as the “price revolution”, with prices increasing on average perhaps six times over 150 years (Kimutai too, 2017). This mainly stemmed from the immediate influx of gold and silver from the New World into Habsburg Spain. The silver spread throughout a previously cash starved Europe and caused widespread inflation. Demographic factors also contributed to upward pressure on prices, with European population growth after previous depopulation caused by the Black Death pandemic (Kimutai too, 2017). Today, there are four main causes of inflation: demand-pull inflation, cost-push inflation, imported inflation, and monetary inflation (Chaluvadi, 2022). Demand-pull inflation is a period of inflation which arises from rapid growth in aggregate demand, this includes the total demand for goods produced domestically, including consumer goods, services, and capital goods (Chaluvadi, 2022). Contrastingly, Cost-Push inflation occurs when the economy experiences rising prices due to higher costs of production and higher input costs. Then there is imported inflation which is inflation caused by the increase in import prices. As imported prices increase, prices of goods made domestically also rise as raw materials are often more expensive. Lastly there is monetary inflation which is a sustained increase in the money supply of a country (or currency area) (Schelkle, 2015).

History of Inflation

Although high levels of inflation seem to have only taken place decades ago, it is still very present today. Recently, inflation has been rising at a rapid rate, and it has been an ongoing issue that millions of individuals have had to experience. Inflation is defined as an overall increase in prices over a period of time. This can mean that the rate at which a value of currency is increasing or falling; generally, when inflation occurs the level for the price of goods and services is rising (Fernando, 2022). Inflation has its positive and negative effects. Some of the positive effects include economic growth and redistribution. The negative effects of inflation include a decrease in purchasing power, evaporation of savings, economic uncertainty, and malaise (a general feeling of discomfort).

One example in history where inflation occurred was the Great Depression of the 1930s. Instead of prices going up, prices went down, which is also known as deflation. This was the largest economic downfall the US has ever experienced. Inflation rates reached an all-time low of -10 percent (McMahon, 2014). The stock market crash was a horrible time for everyone, and it was this period when Congress began to take a closer look at inflation, discussing policies they hoped would promote greater economic stability. In 1964, inflation began to really take its place. According to The Great Inflation, inflation in 1964 measured a little more than 1% per year. In the mid 1960s it was increasing, and it reached a high of 14% in 1980 (Bryan, 2013).

The inflation rate responds to each phase of the business cycle, which is the rise and fall of economic growth that occurs over a period of time. It corresponds to a nation’s gross domestic product (GPD), which measures all the goods and services that are produced in the country. This cycle runs in four different phases. The first phase is the expansion phase. This is when inflation is positive, with around a 2% rate of inflation. This is considered an acceptable rate of inflation. If the inflation rate expands past a 3% rate of growth, it can create an asset bubble, which is when the market value of an asset increases more rapidly than its real value. The second phase is known as the “peak,” when expansion ends and contraction begins. As the market resists higher prices, a decline begins. The third phase is the contraction phase. The growth rate of inflation begins to turn negative. If it lasts long enough (two consecutive quarters), it can create a recession. Recession is when deflation can occur. This is a decrease in the prices of goods and services. It can be very dangerous and negatively affect the government and its civilians. The fourth phase is the trough where contraction ends and economic expansion begins. The rate of inflation begins to increase, and the cycle repeats itself (Amadeo, 2022).

One of the more recent factors that has led to the recent rise of inflation is the COVID-19 pandemic. Also known as coronavirus, this disease that began to spread internationally around March of 2020 has been one of the events most responsible for the recent rise of inflation, because there was a large increase in the demand for different goods and services. In the beginning of the pandemic, governments issued warnings to all citizens to stay safe, and the best way to do this was by staying at home. As many people were worried about the illness spreading, millions of people stayed in their homes in hopes that the virus would pass over. During this time, people panicked and frantically stockpiled goods like toilet paper, hand sanitizer, and towels. This led to a rapid increase in the aggregate demand for these services, which is why inflation increased the way it did. The effects of COVID-19 have caused long-lasting and unprecedented levels of suffering. Many people believe that the effects of COVID-19 have “choked” off production. In other words, too much money is being spent on too few goods, which is why there has been a significant decrease in the supply of some products (Economist, 2022).

Another cause of inflation in recent history was Russia’s invasion of Ukraine, which began in late February 2022. This conflict has caused inflation to increase rapidly in countries around the globe, such as Turkey and Argentina, which were already dealing with high inflation. Many hardly thought that inflation would rise this much. Thirty-eight members of the Organization for Economic Cooperation and Development agreed that they could not see inflation rates rise above 6 percent (Cohen, 2022). One factor which contributed to the inflation caused by the Russia-Ukraine conflict was the sanctions against Russia imposed by many outside countries, including the United States. Russian bombing, blockades, and attacks on Ukraine have cut off the flow of grain from Ukraine, a top producer of wheat for the US. It also raised famine rates in poor food-importing nations (Cohen, 2022).

Recently, the Federal Reserve raised interest rates by three-quarters of a percentage point, the highest since 1994; as a result many people are concerned that the recent rising inflation rates will lead to a recession (Bokat-Lindell 2022). Recession is a period of economic decline where trade and industrial activity are reduced, which usually results in a fall in GDP during two consecutive quarters (Oxford Languages). Two years after the first lockdowns and the spiral of the pandemic, the business cycle seems to be taking a turn for the worse; a recession in America by 2024 now looks even more likely to occur, as “surging food and petrol prices are eating into people’s spending” (Economist, 2022). As of April, consumer prices were 8.3% higher than the year before. As the war rages in Ukraine, supply chain problems continue to increase. Unemployment rates are higher than ever, with two job openings for every unemployed worker in March – the worst since 1950 (Economist, 2022).

In order to find a solution to this problem, it is important to understand what has been driving America’s ‘super-hot’ inflation. More Americans are paying for more expensive food, fuel, and housing, and some are “grasping for answers about what is causing the price burst, how long it might last, and what can be done to resolve it” (Economist, 2022). The main factors that are driving inflation are strong demand, broken supply chains, and service-sector pressures. Early in the pandemic, it was seen that consumers are spending much more than before; households took control of savings as millions were stuck at home. Now, millions of people want their lives back as they take new and limited job opportunities, as well as spend all of the money they saved while living at home. The restricted spending opportunities of the middle pandemic enabled families to spend on everything they could possibly want once they were allowed out of their homes. This type of inflation is known as demand pull. Cost push inflation, the idea that there have been too few goods available as a result of the pandemic, has also been at play. Due to the fact that families have saved up their money, many have run into the problem of the decline in goods. Too many people want too many things, and as a result there have been too few goods to go around (Friedman from Monetary History, 1963). Companies have been able to increase prices on their goods, because customers will be willing to pay as much as they need for new supplies. Lastly, people have been “shifting their spending away from things and back toward experiences as they adjust to life with the coronavirus” (Smialek). As life turned around after months of staying isolated, things like apartments, airline tickets, and hotel rooms have cost more because more people are eager to travel (Smialek, 2022).

Causes of Inflation

Inflation is a global issue that most economies have likely faced to some extent at some point. Some have managed to take care of the situation, while others have reached the point where citizens do not have the ability to purchase items that are essential for meeting basic human needs. Inflation is caused by multiple factors, such as an increase in demand for certain goods, an increase in the production costs of certain goods, and spiraling increases in wages.

When looking at the first cause of inflation we can see that this is a common issue in all economies, making it a main cause of inflation. As people demand a certain service or product, its price increases. This is because businesses tend to increase the price of the item in demand in order to increase profits, thus affecting the consumption of this certain good or service because people are forced to pay more to gain this certain item or service. Another source of increases in demand is a shortage of supply, which then leads to inflation. When an item is in short supply, people will tend to be willing to pay more if they are able, resulting in an increase in its price. This showcases that both demand and supply have an effect on inflation. An example of an incident related to the phenomenon stated above includes the toilet paper issue that occurred during the COVID-19. During the pandemic, U.S. residents experienced a low supply of tissue paper which resulted in high demand for the item. Because of that, the price of this item increased significantly, which contributed to inflation.

Each good or item is manufactured and produced by a combination of multiple items. The final product resulting from the combination of all its components will be sold at a price higher than its production cost. When the production cost of a certain component increases, businesses tend to raise the price of the final product so that they can maintain the production quantity and gain profits.

The third cause of inflation is an increase in people’s wages. Employees are a crucial element and requirement of any organization. Employees earn a certain amount of money in return for their work. But what sometimes happens is that these employees demand an increase in wages, and the only way businesses can manage that without any loss is by increasing the price of the goods or services they are providing to their customers. This will eventually lead to inflation.

Theories of Inflation

Inflation is a relative concept, the utility of which varies from economy to economy implying that it might benefit some economies and damage others. In theory, most economists argue that ‘moderate’ inflation is good for any economy. Moderate inflation, also termed as creeping inflation, occurs as prices of goods and services rise at a single digit rate annually. In other words, as an economy passes through moderate inflation, the prices of goods and services increase but at a steady rate. Inflation allows consumers to expect the continuation of rising current prices. As inflation erodes the purchasing power of money, consumers will demand goods now before prices rise and those same goods become more expensive. Subsequently, a rise in demand from consumers will cause an increase in the production of goods and services, which will increase the profits of companies. When companies earn more profits, there will also be a hike in the wages of workers as an incentive. Hence the standard of living of workers will improve, which ultimately means the economy is prospering. In fact, all this is the theory of Keynesian economists: that demand creates its own supply. Second, moderate inflation removes the risk of deflation, when prices fall. At first glance, deflation looks good from the consumer’s point of view. However, as people wait to see if prices will drop before purchasing goods, it dampens demand, and firms and businesses may consider reducing their production. Consequently, factories will produce less and lay off workers, causing unemployment to rise. This leads to wage deflation, as workers are willing to work for less, and as workers have less money to spend, they tend to reduce demand further. Consequently, firms reduce their prices further, worsening deflation. Deflation is usually defined as either a contraction in the money supply or a fall in prices, as they usually go hand in hand. To further illustrate the negative impacts of deflation, the Great Depression can be used as an example.

The difference between the impacts of inflation and deflation is that with inflation you have an inducement to borrow money, since you will be paying back the loan with less valuable currency later; with deflation it will cost you more, so it tends to lower people’s incentive to borrow. On a society-wide basis, this causes a reduction in economic activity, as less currency is getting pumped into the economy and is saved instead. It results in layoffs, which reduces demand even more, essentially creating a negative feedback loop. Demand for everything other than subsistence foods means the value of your house, stock holdings, and other goods fall as too many producers chase too few consumers. To put it simply, deflation discourages spending which makes economies worse. Slight inflation encourages spending which simulates higher economic growth. To further analyze the topic of inflation, what happens when inflation exceeds the recommended amount? In 2018, Emi Nakamura and her colleagues published a paper about price dispersion for the same products over time. Examining high levels of inflation in the 1970s, they found no indication that prices deviated more than their optimal level, just before the COVID-19 pandemic when inflation was significantly lower. Optimal level means short-term profits are maximized at the optimal production level. It is the output where the marginal revenue derived from the last unit sold equals the marginal cost to produce it. It was concluded that low inflation rates may not be the most favorable option (Economist, 2022). Despite inflation being hated universally by consumers, distinguished economists such as Paul Krugman argue that “efforts to measure [inflation’s] cost come up with embarrassingly small numbers” (Economist, 2022). In 1996, economists Michael Bruno and William Easterly found “no evidence of any relationship between inflation and growth at annual inflation rates less than 40%” (Economist, 2022). From this perspective, high rates of inflation doesn’t seem to affect much, however this is just one opinion on the issue. Contrasting ideologies of high inflation can be seen from economists such as William Hauk, saying “higher-than-normal inflation is bad for the economy for many reasons” (Hauk, 2021). He argues the impact of high inflation costs consumers, for instance when it comes to setting appropriate budgets as basic needs begin to rise. Influential needs like food and gasoline can become unaffordable for people who don’t have rising incomes. Also, despite some having rising wages, exceeding inflation makes it harder for consumers to spot if a certain good is getting more expensive compared to other goods, or just corresponding to average price increase, making it significantly harder for people to budget appropriately. He further accentuates this argument by pressing the issue of hyperinflation, which is simply accelerating inflation. It erodes the real value of currency, as the prices of goods increase. Hauk illustrates the idea of hyperinflation with an extreme case of Zimbabwe in the late 2000s. Hyperinflation can lead to spiraling prices, ergo a collapse in a currency’s value. People will want to spend any money they have as soon as they get it for fear that prices will rise even over short periods of time (Hauk, 2021).

Figure 1: Increasing inflation in Zimbabwe during the late 2000s (Tejvan Pettinger, 2019, p.1)

How inflation affects different people

As established, inflation that extends the capacity of an economy is most likely to be harmful and may have effects that surpass the directly impacted population. However, it is worth considering how the effects of inflation intensify when socioeconomic factors are considered.

The way in which inflation affects different people is seen on a person-to-person level. However, for the sake of time and realism, this paper will only consider wealthy households, lower-income households, those with a higher marginal propensity to save, and finally, those with a higher marginal propensity to consume.

Wealth, upon first consideration, may be ambiguous in definition, but – as defined by the European Central bank – it refers to the value of income and asset wealth, namely, real estate and stock ownership. For reference, the richest 1% of households in the UK have a value of assets at or above £3.6 million – in comparison to the poorest 10% of UK households with assets at £15,400 or less (Hilary Mainwaring, 2022). Thus, with this understanding of the disparity of wealth between the two groups it is important, as economists, but most importantly as people, to recognise that some groups will endure a worse experience than others when living in an economy with a level of inflation that exceeds its capacity.

Inflation, although it means that the value of money decreases, will lead to the phenomenon of asset inflation – a general increase in the value of assets. As previously established there is already such a disproportionate distribution of asset wealth amongst the UK population. Therefore, we may assume that only those in the richest 1% will experience any benefits associated with owning assets. However, there will be a mutual benefit for those asset owners irrespective of their income class – with this common experience being the positive wealth effect.

The “wealth effect” is the notion that when households become richer as a result of a rise in asset values, such as corporate stock prices or home values, they spend more and stimulate the broader economy. Essentially, assets are not excluded from the general increase in price caused by inflation and therefore everyone who owns an asset of any kind will experience this wealth effect. However, it is important to recognize that the intensity of the wealth effect felt by different groups will differ. Therefore, although they are all experiencing the same thing, the confidence to purchase more in their domestic economy will waver in accordance with the intensity of the wealth effect experienced. Those with greater and higher valued assets are more likely to have greater levels of confidence when investing back into the economy, in comparison to those with only a few or low valued assets, who still may not have enough confidence in the economy to spend more generously. This demonstrates that based on the value of assets alone, the behavior and experiences of individuals can differ dramatically.

On the other hand, those who do not own real estate (33% of households) or any assets at all, will not experience this feeling of increased wealth but instead may experience heightened difficulty during times of high inflation. Why? The wealth effect provides people with a heightened sense of confidence to purchase and consume. Although generally this is seen as beneficial and can promote the expansion of a dynamic economy (considering the presence of inflation already within the economy), higher levels of purchasing by a large proportion of households may provoke the arrival of or worsen existing demand-push inflation. Demand-push inflation is a concept described by Friedman in the Monetary History published in 1963, as being ‘too much money chasing too few goods’. Therefore, it is likely that without appropriate intervention or monitoring these additional higher levels of consumption can cause the economy to spiral into dismay – making the idea of recovery an unrealistic goal for the near future and widening the gap between the wealthy and the lower-income individuals.

Much of what has been said above implies that people act solely on the knowledge of their own wealth and the current economic climate. However, we must consider that components such as future inflationary expectations and individual factors all play a part in individual responses. For example, although the wealth effect may encourage purchasing within an economy, if there are expectations that the level of inflation will soon decrease the marginal propensity to consume goods excluding necessities in the present will decrease irrespective of a heightened feeling of wealth. Similarly, if the levels of inflation are presumed to continue to increase, those with lower valued assets may find confidence in the fact that they will continue to grow wealthier in the near future, thus feeling more comfortable with spending more generously on the economy.

With this being said, generally during periods of high inflation consumption within an economy will decrease as the cost of living increases, usually without a proportionate increase in wages. Therefore, most people simply no longer have the liberty to purchase as frivolously as they may have done previously. This will particularly affect those who have a higher marginal propensity to consume as, because of their spending habits, they are less likely to have a comfortable portfolio of savings. Considering the general increase in the price of all goods and services, those people who consume a lot more than they save, especially if they have low bargaining power or are on a fixed wage contract, are likely to endure a much more bleak experience during inflation.

In recognition of what has been discussed prior, it would be logical for us to make the presumption that if those with a higher marginal propensity to consume suffer within an economy with a soaring inflation rate, then those with a higher marginal propensity to save should surely prosper?

Not necessarily. It is true that those with a higher marginal propensity to save will have access to more money, and thus are less likely to experience the extreme effects of inflation such as falling into poverty. As stated by Michael Savage (2022), for savers, ‘Rising inflation at a time when interest rates are low is bad news.’ This is because the effects of inflation mean that the value of money naturally decreases. This, coupled with the fact that interest rates are low (therefore you are not making a large return on your money) will mean that the buying power that your money had when it was put in the bank will be significantly lower when it is withdrawn. However, a common government intervention response to inflation is to increase interest rates, promoting withdrawals from the economy and preventing any further pressure from being applied. This will be beneficial for those individuals with a higher marginal propensity to save, as it means that the return on the money they invested into the bank will increase, and they will be better off (strictly in terms of quantity of money) because of inflation. Thus as stated previously, it is important to have an understanding of the fact that the effects of inflation on different groups are composed of many extraneous variables.

How inflation affects different people

As established, inflation that extends the capacity of an economy is most likely to be harmful and may have effects that surpass the directly impacted population. However, it is worth considering how the effects of inflation intensify when socioeconomic factors are considered.

The way in which inflation affects different people is seen on a person-to-person level. However, for the sake of time and realism, this paper will only consider wealthy households, lower-income households, those with a higher marginal propensity to save, and finally, those with a higher marginal propensity to consume.

Wealth, upon first consideration, may be ambiguous in definition, but – as defined by the European Central bank – it refers to the value of income and asset wealth, namely, real estate and stock ownership. For reference, the richest 1% of households in the UK have a value of assets at or above £3.6 million – in comparison to the poorest 10% of UK households with assets at £15,400 or less (Hilary Mainwaring, 2022). Thus, with this understanding of the disparity of wealth between the two groups it is important, as economists, but most importantly as people, to recognise that some groups will endure a worse experience than others when living in an economy with a level of inflation that exceeds its capacity.

Inflation, although it means that the value of money decreases, will lead to the phenomenon of asset inflation – a general increase in the value of assets. As previously established there is already such a disproportionate distribution of asset wealth amongst the UK population. Therefore, we may assume that only those in the richest 1% will experience any benefits associated with owning assets. However, there will be a mutual benefit for those asset owners irrespective of their income class – with this common experience being the positive wealth effect.

The “wealth effect” is the notion that when households become richer as a result of a rise in asset values, such as corporate stock prices or home values, they spend more and stimulate the broader economy. Essentially, assets are not excluded from the general increase in price caused by inflation and therefore everyone who owns an asset of any kind will experience this wealth effect. However, it is important to recognize that the intensity of the wealth effect felt by different groups will differ. Therefore, although they are all experiencing the same thing, the confidence to purchase more in their domestic economy will waver in accordance with the intensity of the wealth effect experienced. Those with greater and higher valued assets are more likely to have greater levels of confidence when investing back into the economy, in comparison to those with only a few or low valued assets, who still may not have enough confidence in the economy to spend more generously. This demonstrates that based on the value of assets alone, the behavior and experiences of individuals can differ dramatically.

On the other hand, those who do not own real estate (33% of households) or any assets at all, will not experience this feeling of increased wealth but instead may experience heightened difficulty during times of high inflation. Why? The wealth effect provides people with a heightened sense of confidence to purchase and consume. Although generally this is seen as beneficial and can promote the expansion of a dynamic economy (considering the presence of inflation already within the economy), higher levels of purchasing by a large proportion of households may provoke the arrival of or worsen existing demand-push inflation. Demand-push inflation is a concept described by Friedman in the Monetary History published in 1963, as being ‘too much money chasing too few goods’. Therefore, it is likely that without appropriate intervention or monitoring these additional higher levels of consumption can cause the economy to spiral into dismay – making the idea of recovery an unrealistic goal for the near future and widening the gap between the wealthy and the lower-income individuals.

Much of what has been said above implies that people act solely on the knowledge of their own wealth and the current economic climate. However, we must consider that components such as future inflationary expectations and individual factors all play a part in individual responses. For example, although the wealth effect may encourage purchasing within an economy, if there are expectations that the level of inflation will soon decrease the marginal propensity to consume goods excluding necessities in the present will decrease irrespective of a heightened feeling of wealth. Similarly, if the levels of inflation are presumed to continue to increase, those with lower valued assets may find confidence in the fact that they will continue to grow wealthier in the near future, thus feeling more comfortable with spending more generously on the economy.

With this being said, generally during periods of high inflation consumption within an economy will decrease as the cost of living increases, usually without a proportionate increase in wages. Therefore, most people simply no longer have the liberty to purchase as frivolously as they may have done previously. This will particularly affect those who have a higher marginal propensity to consume as, because of their spending habits, they are less likely to have a comfortable portfolio of savings. Considering the general increase in the price of all goods and services, those people who consume a lot more than they save, especially if they have low bargaining power or are on a fixed wage contract, are likely to endure a much more bleak experience during inflation.

In recognition of what has been discussed prior, it would be logical for us to make the presumption that if those with a higher marginal propensity to consume suffer within an economy with a soaring inflation rate, then those with a higher marginal propensity to save should surely prosper?

Not necessarily. It is true that those with a higher marginal propensity to save will have access to more money, and thus are less likely to experience the extreme effects of inflation such as falling into poverty. As stated by Michael Savage (2022), for savers, ‘Rising inflation at a time when interest rates are low is bad news.’ This is because the effects of inflation mean that the value of money naturally decreases. This, coupled with the fact that interest rates are low (therefore you are not making a large return on your money) will mean that the buying power that your money had when it was put in the bank will be significantly lower when it is withdrawn. However, a common government intervention response to inflation is to increase interest rates, promoting withdrawals from the economy and preventing any further pressure from being applied. This will be beneficial for those individuals with a higher marginal propensity to save, as it means that the return on the money they invested into the bank will increase, and they will be better off (strictly in terms of quantity of money) because of inflation. Thus as stated previously, it is important to have an understanding of the fact that the effects of inflation on different groups are composed of many extraneous variables.

Inflationary goals and inflation targeting

Every country has a distinctive goal for inflation, but how do we identify this goal? That is where inflation targeting comes in. Recently, governments and many central banks have adopted an “inflation targeting technique”. In the framework of inflation targeting, the central bank would estimate a projected inflation rate and then attempt to steer the inflation directly towards that target using miscellaneous tools from interest rate changes and many other techniques. It is a way to specify an inflation rate as an explicit goal and use different policies and techniques to achieve it. Pros and cons can come from establishing a goal of inflation. Some of the positives that come from inflation targeting are: it allows central banks to respond to shocks in the domestic economy and focus on domestic considerations. It also reduces investor uncertainty and allows investors to predict changes in interest rates. Inflation targeting can also allow for more eminent transparency in monetary policies. However, many analysts and people believe that when inflation targeting is focused, it can formulate an atmosphere that includes unsustainable speculative bubbles and distortions in the economy, which can lead to a financial crisis like the one in 2008, the most severe worldwide economic crisis since the Great Depression in 1929. It was caused by distortions and speculative bubbles in the economy, but also low-interest rates, easy credit, and insufficient regulation. Other critics believe that it encourages responses that seem inadequate to terms-of-trade supply shocks; the terms of trade are defined as the ratio between export and import prices.

Inflation targeting was popularized when it became a central goal of the U.S. Federal Reserve in January 2012 as a response to the fallout of the 2008-2009 financial crisis. The Fed hoped it would help promote their dual mandate of low unemployment and supporting stable prices by setting an explicit inflation goal to the public. As inflation targeting seems to be adopted by more governments over the years, the majority of the population is leading toward inflation targeting as it seems to be more effective than the “alternative monetary policy frameworks in anchoring public inflation expectations” (Jahan, 2022). Inflation targeting has been a triumphant method that has been practiced in a growing number of diverse countries over the past 20 years. As more countries adopt this practice, many additional countries will subsequently move toward this framework. Over time, inflation targeting has proven to be a flexible and robust framework that has been extremely resilient in the face of any change of circumstance, including the recent financial crisis during the pandemic in 2020.

Many countries worldwide have adopted inflation targeting irrespective of their income level. Some of these countries include New Zealand, which adopted the targeting practice in 1990 with the goal of 1-3%. Canada adopted the practice in 1991 with the goal of 2%. Australia and Sweden adopted it in 1993 with the goals of 2-3% and 2% respectively. The Czech Republic and Israel adopted it in 1997 with the goals of 2-3% and 1-2%. The United Kingdom also adopted it in 1991 with a strict goal of 2%. Poland, Brazil, Chile, and Columbia all joined in the years 1999-2000 with respective goals of 1-2.5%, 2-4.5%, -1-3%, and 2-4%. An additional nine countries would follow the rest in 2001-2002. In the year 2005, 3 new countries joined. These included Guatemala, Indonesia, and Romania, with goals a little higher than usual, ranging from 1-4% and 1-5%. In 2007, Ghana stated the highest inflation rate goal at 2-8.5%. In the most recent decade, five new countries joined this practice. Japan, Moldova, India, Kazakhstan, and Russia stated their goals in the years 2013-2015; Japan with a strict rate of 2% and Russia and Kazakhstan with a goal of 4%. One thing to note is that there are also several central banks in more advanced economies, including the European Central bank (ECB) as well as the US federal reserve, that have adapted to many of the elements of inflation targeting, but they do not call themselves inflation targets officially.

As we take a glance at the past countries to join inflation targeting and their goals, there are a few patterns to notice. One pattern is that many countries have a strict goal of 2%. Why is that? Well, the reason for the popular 2% goal is that many believe it is low enough for the economy to reap the benefits of price stability while providing a safety margin against the risk of deflation. Setting a goal of 2% provides a sufficient margin to allow for a smoother adjustment of “macroeconomic imbalances” (Jahan, 2022) across the countries in Europe. It also helps prevent inflation from falling into negative territory in individual countries. This goal also helps reduce “wage rigidities,” which can cause unemployment. Finally, the goal can provide a positive measurement bias in the price index, meaning that the accurate level of inflation is lower than the measured level. The goal of 2% provides a clear anchor for inflation expectation which is essential for maintaining price stability. The Federal Reserve also adopted the goal of 2%. They believe that the goal of 2% allows for maximum employment and price stability. Having a low rate of inflation can give insight to businesses and households since they can expect inflation to remain low and stable; this leads to them making sound decisions for investments, and savings, and all of these sound decisions can contribute to a well-functioning economy.

Fighting inflation

In the past two years there has been a rise in inflation in both the United States and the United Kingdom. These two countries are not only trying to slow down the spike in inflation but they are also trying to find solutions, so that their economies can remain stable.

One of the ways both the United States and the United Kingdom have been trying to fight this problem is by raising interest rates. “An interest rate is the money people get on any savings they have. It’s also the charge they need to pay on their loans and mortgages” (Bank of England, 2022). The higher the interest rates are, the more expensive it is to borrow money. This idea will encourage people to save their money, instead of spending it whenever they want. If governments lowered interest rates, borrowing money would be easier and cheaper, so people would not have the motivation to save and they would keep spending, and consequently inflation would continue to grow. The idea behind higher interest rates is that if people spend less money on certain goods, then “prices will rise more slowly,” and inflation will lower as time goes on (Bank of England, 2022). The Bank of England is trying to “influence” interest rates by using base rates; base rates “determine the interest rate [the Bank of England] pay[s] to commercial banks that hold money with [the Bank]. It influences the rates those banks charge people to borrow money or pay on their savings” (Bank of England, 2022).

The U.S. has also come up with ideas on how to lower the risk of high inflation. Experts have come up with twelve ways the White House can “combat” the rise of inflation right now and in years to come. One way would be to “make America produce again” (Stein and Siegal, 2022). America used to be a primary country for production of certain products. With the recent shortages of goods in the country, experts believe that to boost supply and availability America should create what the country needs (Stein and Siegal, 2022). Another way that some American economists think would help fight the increase of inflation is to bring back price controls. Price controls are a “government regulation establishing a maximum price to be charged for specified goods and services” (Dictionary). The problem with price controls and a reason that many people are hesitant about their return is that “artificially holding down prices leads to shortages” (Casselman and Smialek, 2022, p.6). People will demand more, resulting in less supply. Another reason there is a general dislike around the idea of price controls, is that raising the prices of products too high will create less revenue as people will not want to buy as much, and lowering the cost of certain products will not allow companies to make as much revenue, which then prevents them from producing more products. There has been an ongoing debate regarding price controls, and economists are still trying to decide if it could be a beneficial way to fight inflation. Interest rates and price controls are just some of the ways that economists are saying could help with this recent spike in inflation (Casselman and Smialek, 2022).

Inflation cannot continue increasing without creating the threat of another global financial crisis. Inflation does not need to disappear completely because that would not be beneficial for the economy either, however, it cannot be extremely high as this is not sustainable. The U.K. government has put in place a 2% inflation target so that there can still be a “drive in economic growth” (Bank of England, 2022). “A low and stable rate of inflation helps to create a healthy economy” (Bank of England, 2022). If certain prices are unpredictable, people do not know what to save up for, when to spend, or what they want to invest in. There has to be a happy medium, there cannot be too much or too little. Inflation may never go away, however, governments today are trying hard to stabilize and find solutions to keep inflation at a low rate.

Conclusion

Throughout this article, we have explored inflation in its entirety, considering factors that have led to its arrival, worsening and regulation. The recent rise of inflation has caught many people’s attention, however, there are several ways in which people and governments can make an effort to end the high inflation rates. One way is through raising interest rates, as more people would then be inclined to let their money sit in the bank. This would create a multiplier effect as more people would then save more, leading to a population with an overall higher marginal propensity to save rather than consume. Other solutions include increasing the production of goods and services, modifying price controls through the monetary policy and controlling the money supply. Inflation is important to understand because it occurs globally and affects millions of lives daily. Inflation is a serious problem, whose effects can force an economy into hardship. The effects of inflation are not only economical but also social and can inhibit the ability of families to buy certain goods, especially considering that increases in wages, if any, are rarely proportional to the rate of inflation. On the other hand, if the price of products decreases, known as deflation, the economy will seize up and no one will be willing to spend their money. Therefore, if the government can try to target a set percentage of inflation, and individuals make an effort to create change, inflation will become less of a problem. By decreasing the inflation rate, prices will become much more stable and people will live better lives.

Works Cited

“A Recession in America by 2024 Looks Likely.” The Economist, 2 June 2022, www.economist.com/leaders/2022/06/02/a-recession-in-america-by-2024-looks-likely. Accessed 24 June 2022.

Amadeo, Kimberly. “US Inflation Rate by Year: 1929-2023.” The Balance, 11 May 2022, www.thebalance.com/u-s-inflation-rate-history-by-year-and-forecast-3306093#:~:text=Business%20Cycle%20Phases.-. Accessed 24 June 2022.

Bokat-Lindell, Spencer. “Opinion | Is Inflation about to Cause a Recession?” The New York Times, 22 June 2022, www.nytimes.com/2022/06/22/opinion/inflation-recession-federal-reserve.html?searchResultPosition=1. Accessed 24 June 2022.

Bryan, Michael. “The Great Inflation | Federal Reserve History.” Www.federalreservehistory.org, www.federalreservehistory.org/essays/great-inflation#:~:text=In%201964%2C%20inflation%20measured%20a. Accessed 24 June 2022.

Bank of England. (2022, February 3). What is inflation? Retrieved from www.bankofengland.co.uk website: https://www.bankofengland.co.uk/knowledgebank/what-is-inflation

Bank of England. “How Does the Housing Market Affect the Economy?” Bank of England, 18 Mar. 2020, www.bankofengland.co.uk/knowledgebank/how-does-the-housing-market-affect-the-economy.

Casselman, B., & Smialek, J. (2022, January 13). Price Controls Set Off Heated Debate as History Gets a Second Look. The New York Times. Retrieved from https://www.nytimes.com/2022/01/13/business/economy/inflation-price-controls.html

Cohen, Patricia. “How Inflation Became a Global Problem.” The New York Times, 10 June 2022, www.nytimes.com/2022/06/10/business/how-inflation-became-a-global-problem.html?searchResultPosition=1. Accessed 24 June 2022.

“Covid-19 Could Lead to the Return of Inflation—Eventually.” The Economist, 18 Apr. 2020, www.economist.com/finance-and-economics/2020/04/18/covid-19-could-lead-to-the-return-of-inflation-eventually. Accessed 24 June 2022.

Fernando, Jason. “Inflation.” Investopedia, 12 Jan. 2022, www.investopedia.com/terms/i/inflation.asp. Accessed 24 June 2022.

“From Savings to Shopping, Will Higher Inflation Ruin Your Finances?” The Guardian, 8 Aug. 2021, www.theguardian.com/money/2021/aug/08/from-savings-to-shopping-will-higher-inflation-ruin-your-finances.

“Household Total Wealth in Great Britain – Office for National Statistics.” Www.ons.gov.uk, 7 Jan. 2022, www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/totalwealthingreatbritain/april2018tomarch2020

Jahan, S. (2022). Inflation Targeting: Holding the Line. IMF Inflation. Retrieved 18 June 2022, from https://www.imf.org/external/pubs/ft/fandd/basics/target.htm.

Johnson, J. (2000). The Mongol Dynasty. Asia Society. https://asiasociety.org/education/mongol-dynasty

Krugman, P. (2009, September 2). How did economists get it so wrong? The New York Times. Retrieved June 24, 2022, from https://www.nytimes.com/2009/09/06/magazine/06Economic-t.html

Kimutai too, K. (2017, April 25). What Was The Price Revolution? WorldAtlas. https://www.worldatlas.com/articles/what-was-the-price-revolution.html#:~:text=The%20price%20revolution%20is%20a

Krugman, P. (2022, February 8). When do we need new economic theories? The New York Times. Retrieved June 24, 2022, from https://www.nytimes.com/2022/02/08/opinion/economic-theory-monetary-policy.html

Li, T. (2022). Inflation Targeting Definition. Investopedia. Retrieved 25 June 2022, from https://www.investopedia.com/terms/i/inflation_targeting.asp.

McCausland, Phil. “What Is Causing Inflation? Economists Point Fingers at Different Culprits.” NBC News, 16 Feb. 2022, www.nbcnews.com/business/business-news/whats-causing-inflation-economists-point-fingers-different-culprits-rcna16156.

McMahon, Tim. “Inflation and CPI Consumer Price Index 1930-1939.” InflationData.com, 22 Apr. 2014, inflationdata.com/articles/inflation-cpi-consumer-price-index-1930-1939/. Accessed 24 June 2022.

News, A. B. C. (2022, April 17). What can the government do to stop or slow inflation? Retrieved from ABC News website: https://abcnews.go.com/Business/government-stop-slow-inflation/story?id=84031525

Oner, C., & CEYDA ONER is a deputy division chief in the IMF’s Finance Department. (n.d.). F&D article. Inflation: Prices on the Rise. Retrieved June 24, 2022, from https://www.imf.org/external/pubs/ft/fandd/basics/30-inflation.htm

Rubin, David Harrison and Gabriel T. “What Is Inflation and What Causes It? What to Know.” Wall Street Journal, 10 Feb. 2022, www.wsj.com/articles/inflation-definition-cause-what-is-it-11644353564.

Rubin, Gabriel T. “Why Do Prices Keep Going up and What’s the Cause of Inflation?” Wall Street Journal, 10 Dec. 2021, www.wsj.com/articles/what-is-inflation-cause-stock-market-11637623703.

Rusu, Sergiu. “Tourism Multiplier Effect.” Journal of Economics and Business Research, vol. 17, no. 1, 2011, pp. 70–76, www.ceeol.com/search/article-detail?id=568581

Schmidt, J. (2022, June 20). How inflation erodes the value of your money. Forbes. Retrieved June 24, 2022, from https://www.forbes.com/advisor/investing/what-is-inflation/

Smialek, J. (2021, December 15). Inflation has arrived. here’s what you need to know. The New York Times. Retrieved June 24, 2022, from https://www.nytimes.com/article/inflation-definition.html

Sommer, J. (2022, May 14). How Do Higher Interest Rates Bring Down Inflation? The New York Times. Retrieved from https://www.nytimes.com/2022/05/14/business/inflation-interest-rates.html

Schelkle, W. (2015, December 4). optimum currency area | economics | Britannica. Www.britannica.com. https://www.britannica.com/topic/optimum-currency-area

Stein, J., & Siegel, R. (2022b, January 26). What should the White House do to combat inflation? Experts weighed in with 12 ideas. Retrieved from Washington Post Website: https://www.washingtonpost.com/us-policy/2022/01/26/inflation-white-house-experts/

Sousa, Ricardo. Wo R K I N G Pa P E R S E R I E S N O 1 0 5 0 / M AY 2 0 0 9 Wealth Effects on Consumption Evidence from the Euro Area. May 2009.

The Economist Newspaper. (n.d.). Is higher inflation cause for concern? The Economist. Retrieved June 24, 2022, from https://www.economist.com/films/2021/10/08/is-higher-inflation-cause-for-concern

The Fed – Why does the Federal Reserve aim for inflation of 2 percent over the longer run?. Board of Governors of the Federal Reserve System. (2022). Retrieved 18 June 2022, from https://www.federalreserve.gov/faqs/economy_14400.htm.

“The Chicago Question.” The Economist, 28 July 2012, www.economist.com/finance-and-economics/2012/07/28/the-chicago-question.

William Hauk Associate Professor of Economics. (2022, April 19). “Why is inflation so high? is it bad? an economist answers 3 questions about soaring consumer prices.” The Conversation. Retrieved June 24, 2022, from https://theconversation.com/why-is-inflation-so-high-is-it-bad-an-economist-answers-3-questions-about-soaring-consumer-prices-173572